Digital Product

Payroll product for fleet managers

Step 1 Payroll MVP

Step 2 Monetization strategy

Step 3 Introduce Calculation + Itemization

Step 1 Payroll MVP

Step 2 Monetization strategy

Step 3 Introduce Calculation + Itemization

Timeline

12 Weeks

Team

Nirav Mehta, Head of Product

Vedant Khamesra, Product Manager

Diane Jiang, BizOps

Vedant Khamesra, Product Manager

Diane Jiang, BizOps

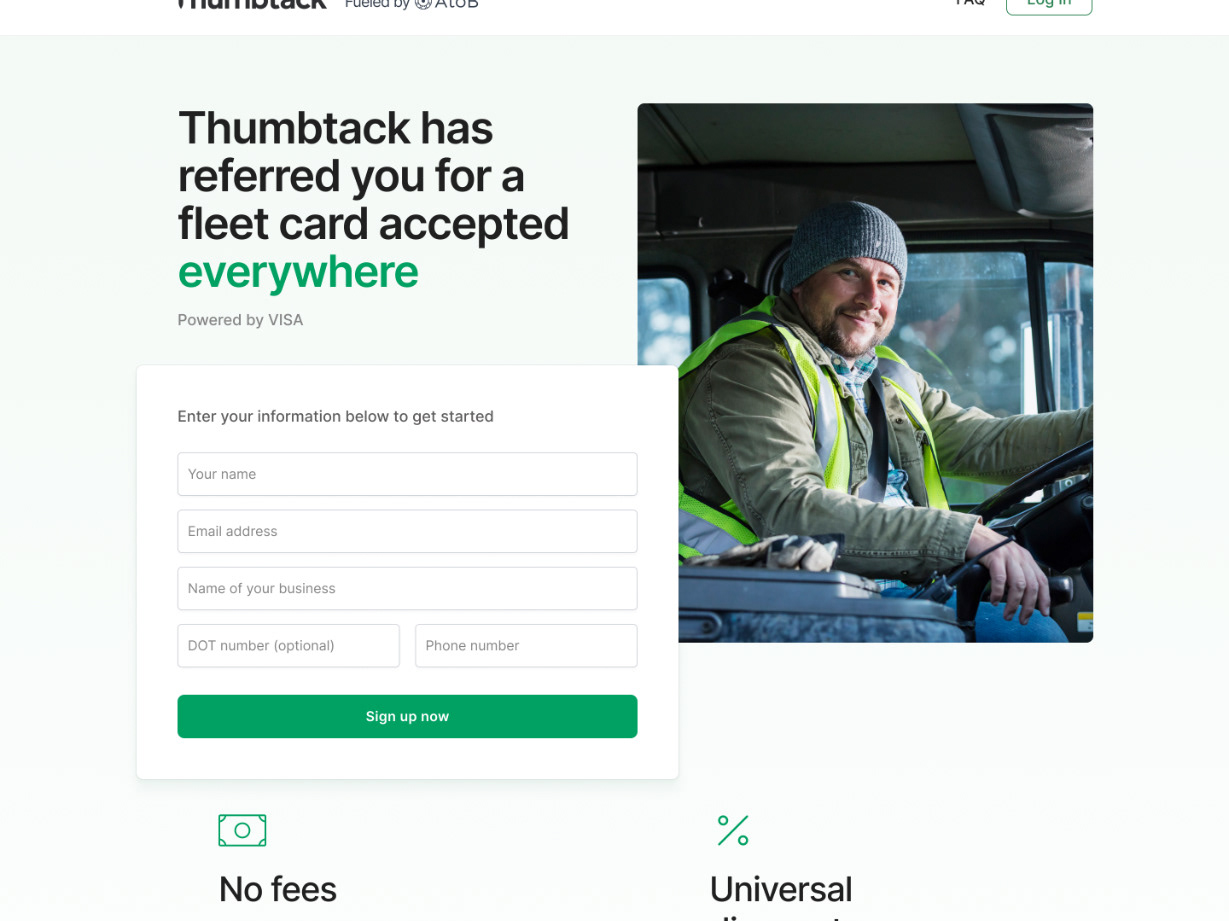

AtoB's flagship product is the Fuel Card, with over 20,000 active users. The main objective was to build out AtoB's ecosystem for existing fleet managers as well as net new trucking companies by offering a Payroll product. We would start with an MVP, building the simplest essential functionality and add on to the foundation with more robust features.

Prioritized Customer Insights

AtoB has an excellent customer support team who connected product with some of the most engaged users willing to offer their feedback. Out of 50 initial user interviews, we distilled the top asks from our drivers and prioritized them on our roadmap.

Understanding Our Users

The most common payroll calculation method our customers (who are in the trucking industry) use is payment by load (a revenue share, ranging from 25-35%). However, calculation methods in general are fragmented for contractors; methods range from auto-payroll (set amount every week) to manual adjustments and advances.

Therefore, a common thread that has emerged is how we can help customers keep track of unexpected payments/advances - this brings us to itemization / documentation.

Therefore, a common thread that has emerged is how we can help customers keep track of unexpected payments/advances - this brings us to itemization / documentation.

Drivers also spearhead a lot more of the payroll process. Some even submit cost reports or proposals of how much they get paid. When a driver/contractor completes a task, they need to send pictures (whether it be a scan or picture of load being delivered).

AtoB wanted to provide Fleet Managers and Drivers a more seamless payroll experience with the ability to do calculations and itemizations in our Payroll product. Key considerations: keep the flow to as few clicks as possible (think CashApp)

Information Architecture

Three key findings highlighted the most important aspects of payroll we should build:

Four calculation types:

• Hourly

• Percentage of Load

• Per Mile

• Flat Rate (covers emergency cash)

• Percentage of Load

• Per Mile

• Flat Rate (covers emergency cash)

Average of 2-3 itemizations per pay period (> 5 are edge cases)

Sending emergency cash was critical

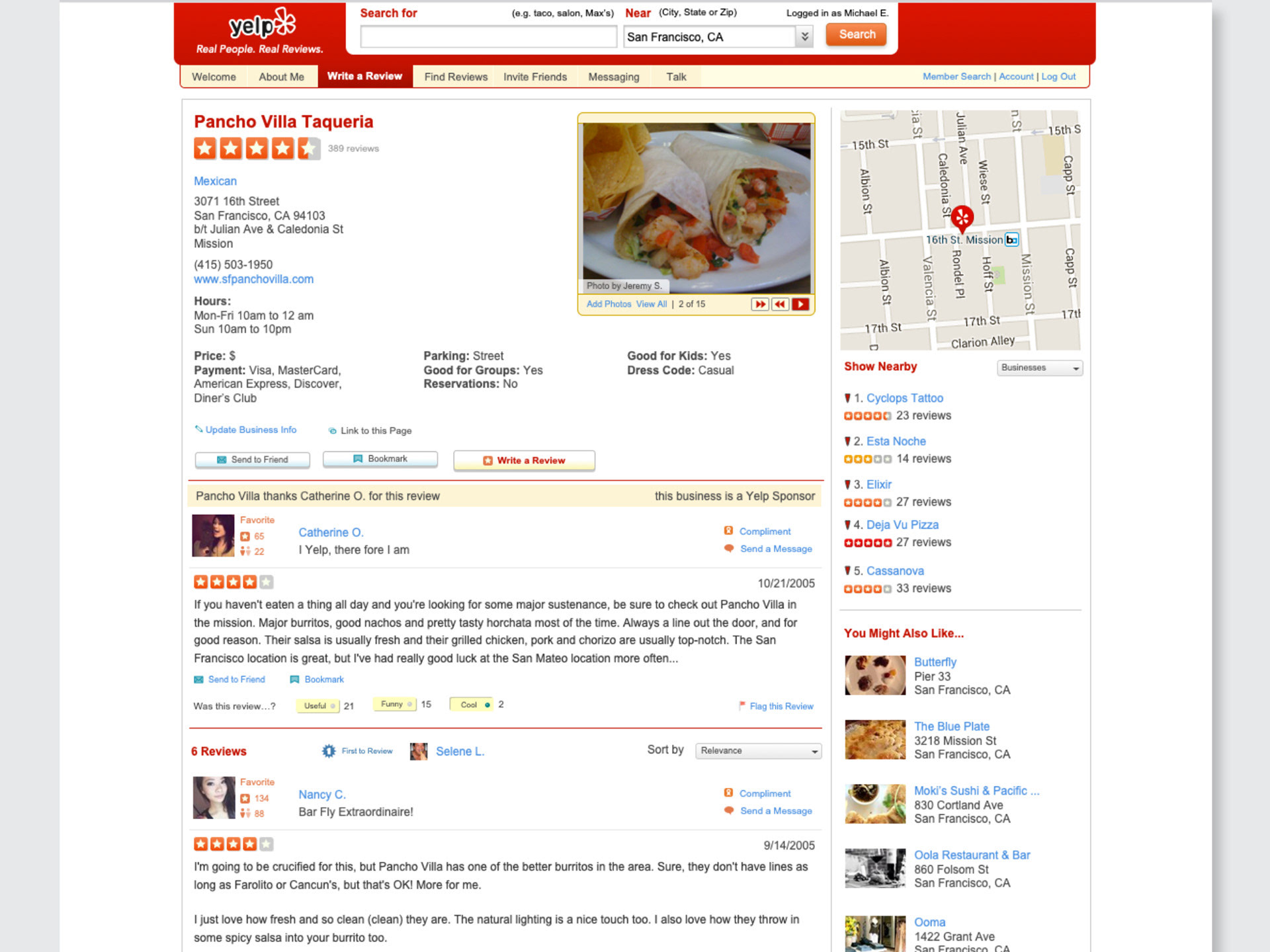

Competitive Analysis

To better inform design decisions, I identified a few competitors offering similar services and functionality. Paywow and Quickbooks both had their own version of itemization so we looked primarily to these services as inspiration for our own UI. Both versions had payroll calculators built in, as well as a very robust categorization system for itemization. We thought we could simplify the categorization for our needs at AtoB.

The user story was a standard linear payment flow, with flexibility to add itemization and allow emergency cash payments easily.

Payroll MVP

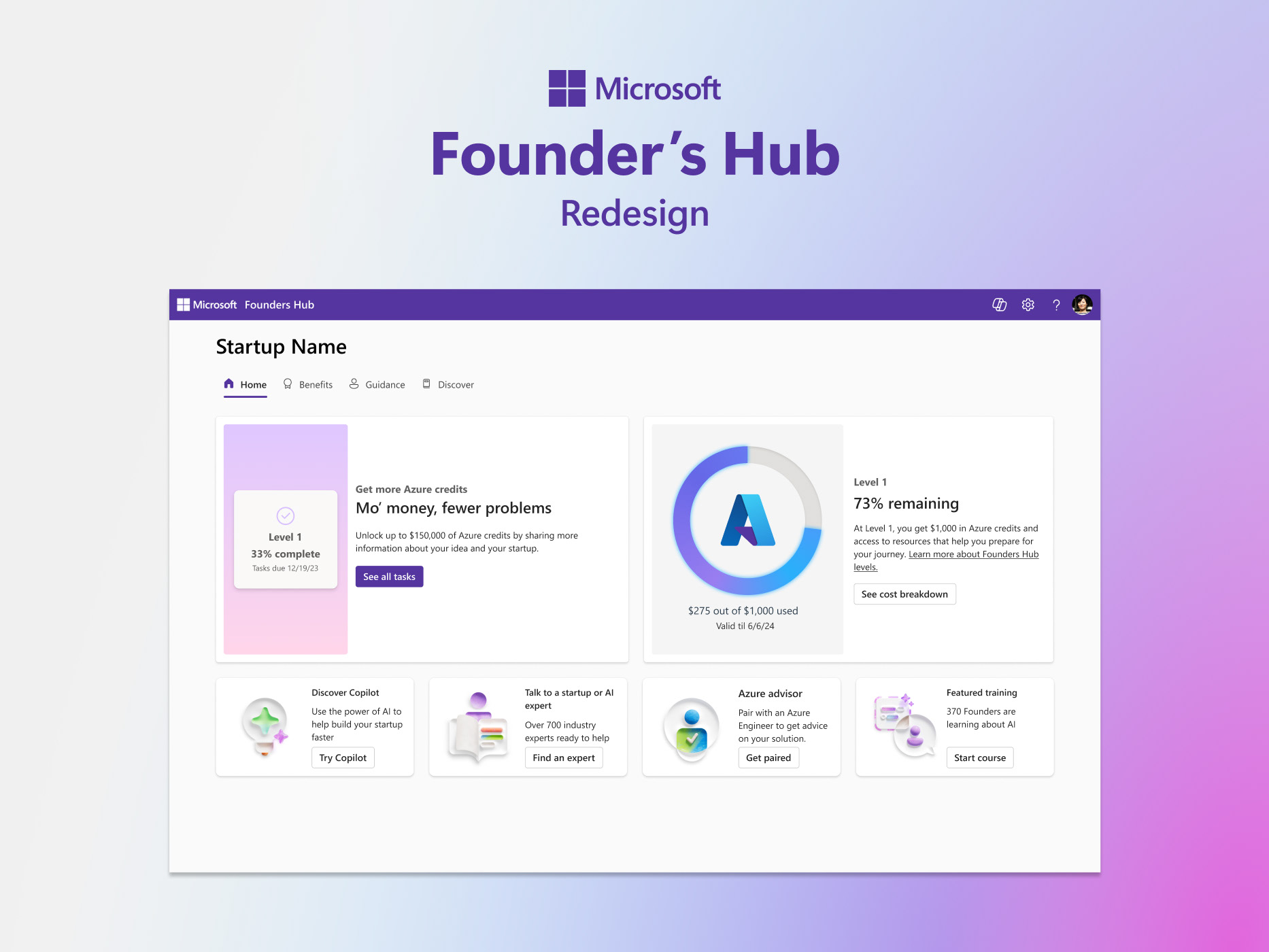

We designed the MVP of Payroll very quickly in the same vein as our dashboard. Its flow is a standard way of moving money in a product with basic UI patterns. Once we figured out that we wanted to add itemization, it would add a fair amount of complexity to the flow, so it was important that this first iteration would be a simple building block to add on to.

Key Considerations

1. New Pricing Model: We’re moving from a flat 0.25% per transaction billing model to a model with two tiers:

a. Subscription model with three components (i) $25/month subscription fee; (ii) $3/month per employee fee; (iii) 0.25-0.50% transaction fee for instant payout

b. Pay-as-you-go instant payout for 1%

2. Impact to Business: This new pricing model will allow us to 2x the monthly revenue per customer + retain a ≥0 contribution margin in almost all cases

a. Subscription model with three components (i) $25/month subscription fee; (ii) $3/month per employee fee; (iii) 0.25-0.50% transaction fee for instant payout

b. Pay-as-you-go instant payout for 1%

2. Impact to Business: This new pricing model will allow us to 2x the monthly revenue per customer + retain a ≥0 contribution margin in almost all cases

Wireframes + Validation

For itemization I created some very basic wireframes to determine screen states and their order as well as understanding where in the flow we wanted the payroll calculator. The first pass we conducted qualitative research with our core users to get initial reactions and understand if our main hypotheses were in the right direction. The steps were modular and easily swappable.

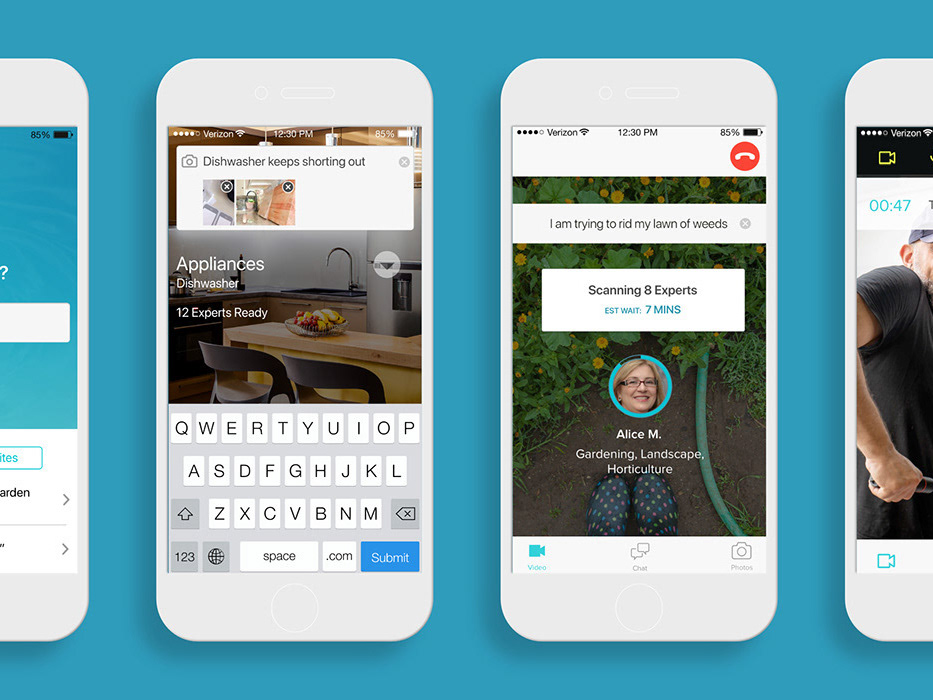

~80% of our users access their account on mobile, but all designs were envisioned as a responsive product.

Iterations

As a high-growth startup, our product velocity required moving past wireframes to hi-fidelity designs after one pass, so we started with the payment calculator added on to the existing MVP UI. From there we added more functionality, in more of an agile approach.

As we moved to build out expenses & reimbursements, I took a refinement approach to the UI. I started with the most basic pieces for a feature and dropped everything required by the PRD onto the screen. From there I stripped out the big pieces and refined the interactions section by section for a more logical organization to the interactions.

Our users were used to working within Microsoft Excel for all of their expense needs, so we experimented with modeling some of the UI in a more elegant way, but realized the product became somewhat unwieldy with some of our edge cases.

Itemization Refinements

As we refined Itemizations, we focused more on the mobile flows, as about 80% of the Fleet Managers accessed their dashboard via mobile.

I highlighted the payment calculator, and focused editing any itemization to its own screen for less overall information density.

AtoB Premium

Payroll was part of a larger AtoB Premium, which incorporated multiple subscription models into the users' accounts. I designed a landing page to highlight multiple benefits of joining AtoB Premium.

Subscriptions

I also had to keep in mind that our product had two concurrent subscriptions on our platform. Each one had to be easily accessed in their Settings page and easily updated or cancelled.

A refined version of mobile with fewer stacked inputs and an itemization flow seperate from the main flow for more clarity.

Additional Metrics

AtoB is currently releasing this feature, but ultimately we increased our user base 2x from 1k to 2k companies using Payroll in two months (19% net new). For recurring payments, we discovered around 77% of fleet managers paid their drivers the exact same way every pay period. And roughly 63% of fleet managers paid ALL of their drivers the same way, a good signal for bulk pay.

The Payroll product helped add 17% growth QoQ for TPV and had over 200% net dollar retention.

Testing

Testing was a bit tricky at AtoB, but we found a 21% increase in transactions with the new flow. We had 8% less funnel abandonment with the updated flow with itemizations.